How do integration costs impact the Total Cost of Acquisition, and why should they be integral to deal planning?

In 2019, a leading B2B SaaS company announced a major acquisition aimed at expanding its market share and technological capabilities. The deal was celebrated in the media, with analysts praising the strategic fit and negotiated purchase price. However, within a year, the company faced unexpected financial strain. The root cause? Grossly underestimated integration costs that soared beyond initial projections, eroding the anticipated value of the deal.

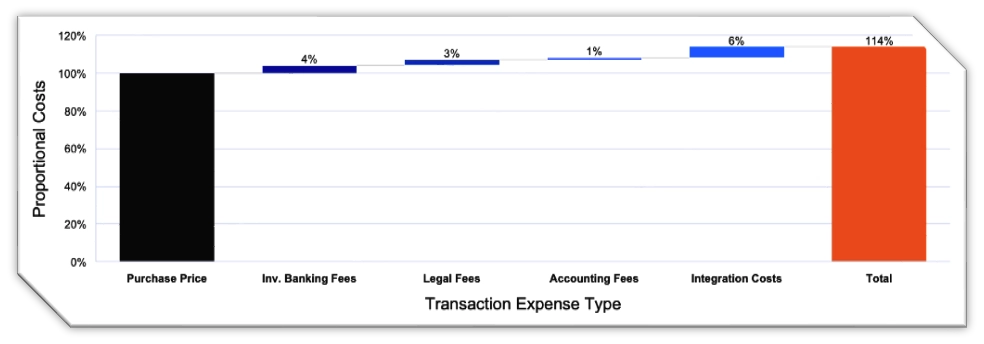

Mergers and acquisitions (M&A) remain pivotal strategies for growth and competitiveness in the B2B SaaS industry. Dealmakers often concentrate on negotiating the purchase price and managing known transaction costs such as investment banking fees, legal expenses, and accounting services. While these elements are critical, an overwhelming focus on them can obscure other significant financial considerations.

Integration costs are a crucial component of the Total Cost of Acquisition (TCoA) and should be integral to M&A deal planning. By recognizing and managing these costs effectively, senior leaders and executives can enhance financial forecasting accuracy, mitigate risks, and make more strategic decisions that contribute to successful deal outcomes. Understanding and properly accounting for integration costs is essential for realizing the full potential of mergers and acquisitions in the B2B SaaS industry.

Uncovering the Tangible Expenses Behind Tech Sector Acquisitions

Up until 2022, M&A activities had surged in the B2B SaaS sector over the past decade, driven by rapid technological advancements and the need for companies to scale quickly. While recent years have seen a slowdown, the pace of M&A is likely to accelerate due to the backlog of deals from the recent drought. These transactions are seen as avenues to acquire new technologies, enter untapped markets, and achieve economies of scale. In such a fast-paced environment, securing a favorable purchase price becomes a focal point for deal makers. Typically, executives and corporate development teams invest substantial time and resources in negotiating the purchase price and budgeting for known transaction costs. Investment banking fees, legal counsel, and accounting services are meticulously calculated and scrutinized.

However, this laser-focused approach often leads to a critical oversight: the integration costs post-acquisition. A recent EY study analyzed M&A transaction costs of 229 deals between 2010 and 2022, finding that costs can range from 1% to 4% of the deal value. Notably, in the Technology, Media, and Telecommunications (TMT) sector, companies reported a median integration cost of more than 5.5% of the target revenue. The study also revealed that the degree of change required in the integration strategy, rather than the deal size alone, is a major cost driver. This finding suggests that many companies may be underestimating the true cost of integration, particularly in deals that require significant operational changes.

For senior leaders and executives in B2B SaaS companies, this presents a significant challenge. The failure to account for integration costs can lead to budget overruns, delayed synergy realization, and, in some cases, deal failure. Accurate financial forecasting at the initial stage is deemed essential for securing board approvals and satisfying shareholder expectations. However, the study highlights the importance of looking beyond the purchase price and known transaction costs to consider the full spectrum of integration expenses, which can vary widely based on the complexity of the integration process and the degree of change required in the acquiring company’s operating model. As the M&A market rebounds and deals accelerate, understanding and properly accounting for these integration costs will be crucial for realizing the full potential of acquisitions in the B2B SaaS industry.

Navigating the Hidden Costs of M&A Integration

The challenge of accurately forecasting and managing integration costs extends far beyond simple oversight. It represents a complex interplay of factors that can significantly impact the success of M&A transactions in the B2B SaaS sector. Integration costs encompass a wide range of expenses incurred to effectively combine two entities, including IT system consolidation, workforce restructuring, facility consolidation or closure, rebranding initiatives, and cultural alignment programs. Unlike the more visible upfront transaction costs, these expenses often unfold over an extended period and can be challenging to predict accurately.

The consequences of underestimating integration costs can be severe and far-reaching. Budget overruns are common, leading to strained financial resources and diminished returns on investment. Delayed synergy realization can occur as companies struggle to align operations and cultures, potentially eroding the anticipated value of the deal. In some cases, the failure to adequately account for these costs can even result in deal failure, with the acquiring company unable to fully realize the benefits of the acquisition or struggling to maintain financial stability post-merger.

This landscape calls for a paradigm shift in how B2B SaaS companies approach M&A planning and execution. The traditional focus on purchase price and known transaction costs must evolve to encompass a more comprehensive view of deal economics. By integrating a thorough assessment of potential integration expenses into their deal analysis, companies can develop more realistic projections of the Total Cost of Acquisition (TCoA). This expanded perspective enables more informed decision-making throughout the M&A process, from initial target selection to final negotiations and post-merger integration planning. As the tech sector braces for a potential surge in M&A activity, this holistic approach to cost assessment will be critical in distinguishing successful deals from those that falter under the weight of unforeseen integration challenges.

Transforming Integration Costs into Strategic Advantages

To effectively navigate the complexities of integration costs in M&A transactions, organizations must adopt a comprehensive and strategic approach. This approach encompasses three key areas: conducting thorough financial impact assessments, implementing robust risk mitigation strategies, and leveraging integration cost data for strategic decision-making. By focusing on these critical aspects, companies can enhance their ability to accurately predict, manage, and optimize the Total Cost of Acquisition (TCoA).

These key considerations are designed to not only improve the accuracy of financial projections but also to enhance the overall success rate of M&A transactions in the B2B SaaS sector. By integrating these considerations into their M&A playbook, organizations can better position themselves to realize the full potential of their acquisitions and create sustainable value in an increasingly competitive landscape. Each area offers unique insights and practical strategies for senior executives and deal makers, providing a roadmap for more effective M&A planning and execution.

Assess the Financial Impact of Integration Costs

Integration costs play a crucial role in shaping the Total Cost of Acquisition (TCoA) and can significantly influence the overall success of an M&A deal. A comprehensive financial impact assessment is essential to fully understand the implications of these costs. This process begins with identifying all potential integration expenses, including technology integration, staff training, process alignment, legal compliance, and potential redundancy payouts. Each of these elements contributes to the total financial burden of the acquisition and must be carefully considered.

Accurately quantifying these costs is the next critical step. Utilizing detailed financial models and engaging cross-functional teams can provide valuable insights into hidden costs that might otherwise be overlooked. This collaborative approach ensures a more holistic view of the financial landscape and helps to uncover potential expenses that may not be immediately apparent. By involving experts from various departments, companies can create a more comprehensive and realistic cost estimate.

The final component of the financial impact assessment involves analyzing how integration costs influence cash flow, profitability, and payback periods. This analysis is crucial for presenting a true picture of post-acquisition performance and setting realistic financial expectations. Companies that conduct thorough financial impact assessments are better positioned to meet or exceed their ROI targets post-M&A. This underscores the importance of quantifying integration costs upfront, enabling executives to make more informed decisions about the viability of the deal and set achievable financial goals. By taking a comprehensive approach to financial impact assessment, organizations can significantly enhance their ability to forecast and manage the true costs of acquisitions.

Mitigate Risks Through Early Planning and Monitoring

Effective risk mitigation is paramount in managing integration costs and preventing budget overruns. One key strategy is to begin integration planning during the due diligence phase. This early start allows for the identification of potential challenges and the development of mitigation strategies before the deal is finalized. By anticipating issues in advance, companies can better prepare for the integration process and avoid costly surprises down the line.

Establishing contingency reserves is another crucial aspect of risk mitigation. Allocating a portion of the budget for unforeseen integration expenses provides a financial buffer that can absorb unexpected costs without derailing the overall budget. This proactive approach helps maintain financial stability throughout the integration process and can prevent minor setbacks from escalating into major financial crises.

Regular monitoring and reporting are essential for tracking integration progress and expenditures against the budget. Implementing robust systems to monitor these aspects ensures transparency and enables timely corrective actions when necessary. This ongoing oversight allows companies to identify potential issues early and make adjustments to keep the integration process on track, both financially and operationally. By proactively managing risks associated with integration costs, companies can avoid common pitfalls that lead to financial strain and operational disruptions, ultimately increasing the likelihood of a successful merger or acquisition.

Leveraging Integration Costs for Strategic Decision-Making

Incorporating integration costs into the planning process leads to more informed negotiations and valuation adjustments. By using comprehensive cost data, executives can negotiate purchase prices and deal terms that more accurately reflect the true cost of the acquisition. This awareness of integration expenses can justify price adjustments or lead to the development of creative deal structures that fairly distribute the financial burden between buyer and seller.

Aligning integration plans with corporate strategy is another critical aspect of strategic decision-making. By ensuring that integration efforts support long-term strategic objectives, companies can maximize value creation and enhance their competitive advantage. This alignment helps to justify integration costs by demonstrating how they contribute to broader business goals and long-term success.

A recent PwC study on M&A integration underscores the importance of strategic decision-making in successful integrations. The study found that successful M&A organizations develop holistic value creation plans early in the deal process, which include critical elements such as synergy targets, ownership assignment, detailed execution plans, tracking processes and tools, program governance, and go-to-market goals. These companies were twice as effective at achieving go-to-market goals by leveraging their strength in customer relationship management and deploying enabling technologies. Moreover, successful organizations were better at building the institutional muscle to capture both revenue and cost synergies, achieving “very favorable” results at a much higher rate than others. This strategic approach to integration planning and execution contributes significantly to the overall success of M&A transactions.

Recognizing the Ripple Effect

The critical impact of integration costs on the Total Cost of Acquisition cannot be overstated in the realm of B2B SaaS mergers and acquisitions. Overlooking these expenses can lead to significant financial overruns, diminished deal value, and ultimately, failure to achieve strategic objectives. For senior leaders and executives in the industry, integrating these costs into M&A planning is not just a financial imperative but a strategic one. By conducting thorough financial impact assessments, proactively mitigating risks, and making informed strategic decisions, companies can significantly enhance the success rate of their acquisitions and deliver tangible value to shareholders.

As the M&A landscape continues to evolve, emerging trends in integration cost management offer new opportunities to improve accuracy and efficiency. Advanced financial modeling tools and data analytics are enabling more precise forecasting and real-time monitoring of integration expenses. Simultaneously, the increasing complexity of technology integrations in SaaS companies underscores the need for specialized expertise in planning and execution. Those who recognize and adeptly manage integration costs will be better positioned to capitalize on growth opportunities and maintain a competitive edge in the dynamic B2B SaaS market. By embracing these strategies and leveraging emerging tools, organizations can navigate the complexities of M&A with greater confidence and success.