How can a thorough understanding of integration costs enhance the valuation and success of an acquisition?

In 2023, a leading B2B SaaS company acquired a promising startup for $500 million, hailing it as a game-changing move. Six months later, the acquirer’s stock plummeted as they announced an additional $200 million in unexpected integration costs. This cautionary tale underscores a critical yet often overlooked aspect of mergers and acquisitions (M&A) in the B2B SaaS industry: the true cost of integration.

As technology companies pursue growth and expand their capabilities, the attention often gravitates toward the headline purchase price. However, more executives are recognizing that the Total Cost of Acquisition (TCoA) encompasses far more than the initial financial outlay. This article emphasizes that a comprehensive understanding and careful management of integration costs are not just best practices — they are pivotal for both accurate valuation and the long-term success of mergers and acquisitions.

Overlooking Integration Costs in M&A

The current M&A environment, particularly within tech and SaaS sectors, integration costs are more complex than ever due to heightened regulatory scrutiny and the growing dominance of private equity in tech. Regulatory bodies like the U.S. Department of Justice and the European Commission are increasingly involved in scrutinizing deals, adding an additional 3–6 months to timelines and, in some cases, even blocking transactions altogether. For instance, in 2023, regulatory bodies challenged over $361 billion in deals, with nearly one-third either abandoned or requiring significant restructuring. This complexity has shifted the focus of M&A professionals, who must not only consider the financial metrics but also preempt regulatory challenges and factor in delays that could increase costs and affect overall deal value.

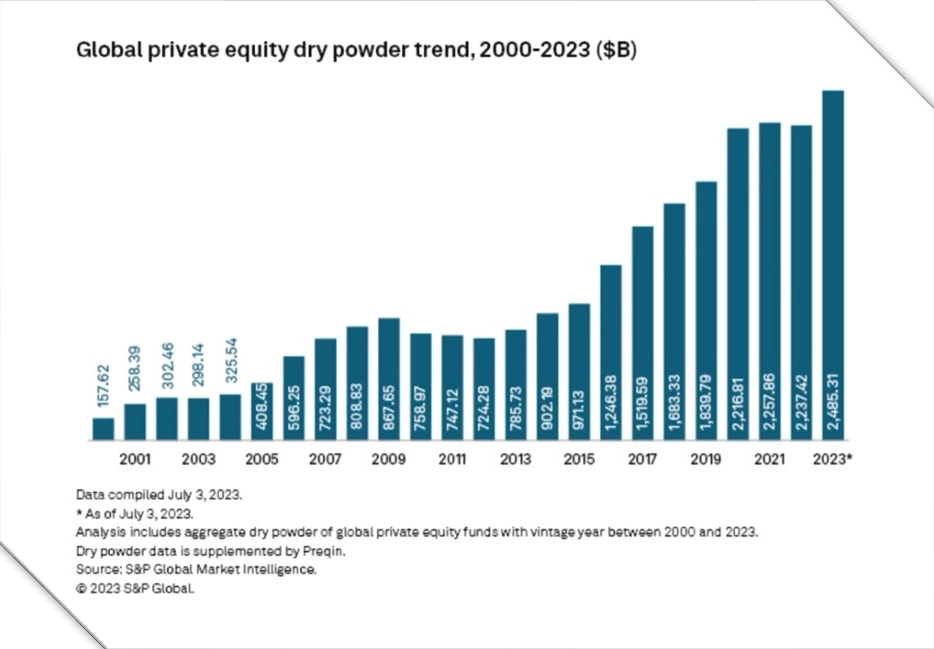

Moreover, private equity (PE) firms now hold a record $2.49 trillion in dry powder, positioning them as dominant players in the tech sector. In 2023, PE firms led 57% of public-to-private tech deals, nearly doubling their presence from previous years. While their operational expertise often adds value to their acquisitions, they face the same regulatory challenges that affect timelines and valuation outcomes. This rise of PE involvement adds another layer to integration planning, as financial buyers often prioritize quicker, higher-margin returns, complicating long-term integration strategies.

For senior leaders and executives in B2B SaaS companies, this situation presents both a challenge and an opportunity. Those who can accurately assess and plan for integration costs gain a significant competitive advantage in deal-making and post-acquisition success. This is particularly relevant given that vertical SaaS comprised 42% of all SaaS M&A deals over the last five years, indicating a trend towards more specialized integrations that may come with their own unique challenges and costs.

Confronting Underestimated Integration Challenges

Beyond regulatory delays, today’s M&A environment is further complicated by increased competition for high-quality assets, particularly in tech and SaaS. Despite a 27% year-over-year decline in SaaS deal valuations by Q4 2023, high-quality assets still commanded a 29% premium, driven by private equity’s aggressive participation. These dynamics create pressure on acquirers to quickly demonstrate value while managing not only the technical aspects of integration but also organizational culture, talent retention, and compliance with ever-changing regulatory standards.

Consider the case of Cisco’s acquisition of Splunk, announced in September 2023. The $28 billion deal was one of the largest in the SaaS industry for the year, with Cisco paying $157 per share in cash, representing a 31% premium to Splunk’s closing share price on September 20, 2023. The acquisition was celebrated as a strategic move, giving Cisco access to Splunk’s powerful data observability and security platforms.

While it’s too early to assess the full integration costs of this deal, it highlights the scale and complexity of integrations in the current SaaS M&A landscape. Cisco, as an experienced acquirer, likely factored in significant integration costs beyond the purchase price. However, the true test will come in the months and years following the deal’s close, as Cisco works to integrate Splunk’s technology, talent, and customer base into its existing operations.

Balancing Cost and Benefit Tradeoffs in M&A

Before exploring specific strategies, it’s crucial to understand that integration costs are not simply operational expenses but strategic investments that can greatly influence the success of an acquisition. A clear grasp of these costs allows for better decision-making, more effective negotiations, and proactive risk management. In an environment of increased regulatory scrutiny and private equity involvement, companies that prioritize integration planning are better positioned to manage the complexities of modern M&A transactions.

A common misconception is that integration costs are one-time expenses that can be easily absorbed. In reality, these costs often extend over several years and can significantly affect the acquiring company’s financial performance and ability to realize synergies. Senior leaders who incorporate these costs into their valuation models and negotiate with foresight can mitigate risks and enhance long-term outcomes.

Incorporate Integration Costs in Valuation Models

Incorporating integration expenses into valuation models is crucial for reflecting the true cost of an acquisition. While traditional valuation methods often focus solely on the target company’s financial performance and potential synergies, a more comprehensive approach is needed in today’s complex SaaS landscape. This approach begins with detailed integration cost modeling, which accounts for all categories of integration costs over a 3–5 year period post-acquisition. Such a model should encompass both one-time costs and ongoing expenses, providing a holistic view of the financial implications of the merger.

With this detailed model in hand, executives can then conduct a thorough cash flow impact analysis. This analysis assesses how integration costs will affect the combined entity’s cash flows, considering the timing of integration expenses and their impact on the realization of synergies. By mapping out these cash flow implications, decision-makers can better understand the short-term financial pressures and long-term value creation potential of the acquisition.

The final piece of this comprehensive valuation approach involves adjusting key metrics to account for integration risks and costs. This might involve applying higher discount rates or using probability-weighted scenarios when calculating Net Present Value (NPV) and Internal Rate of Return (IRR). Additionally, creating a realistic timeline for synergy realization that accounts for integration challenges is crucial. Often, the full benefits of an acquisition are delayed due to integration hurdles, and acknowledging this in the valuation model leads to more accurate projections. By incorporating these elements, executives can develop a more nuanced and accurate picture of the acquisition’s true value and potential return on investment, ultimately leading to better-informed decision-making in the fast-paced world of SaaS M&A.

Negotiate Terms with Cost Insights

A comprehensive understanding of integration costs can significantly enhance a company’s negotiating position in SaaS M&A deals. Armed with detailed cost projections, executives can approach the negotiation table with a clearer picture of the true total cost of acquisition. This insight allows them to advocate for a more favorable purchase price that reflects not just the target company’s standalone value, but also the full spectrum of integration expenses. According to the Software Equity Group’s 2024 Annual SaaS Report, the median EV/TTM Revenue multiple for SaaS M&A deals in Q4 2023 was 3.8x, down 10% from Q3 2023 and 27% year-over-year. However, high-quality assets continued to command a premium relative to the market, underscoring the importance of nuanced valuation approaches that account for integration complexities.

Beyond price adjustments, a thorough grasp of integration costs enables executives to structure more sophisticated deal terms. This might include designing earn-outs and contingent payments that align the seller’s compensation with successful integration milestones, effectively sharing the risk of integration challenges between both parties. Additionally, negotiators can leverage their understanding of integration needs to secure commitments from the seller for specific transition services, potentially reducing both integration costs and risks. This approach not only helps to mitigate potential integration pitfalls but also fosters a collaborative environment between buyer and seller throughout the transition process.

The 2021 acquisition of Slack by Salesforce provides a compelling real-world example of this strategy in action. During negotiations, Salesforce’s detailed integration cost analysis led to a deal structure that included both cash and stock components, with additional payouts tied to integration milestones and revenue targets. This approach helped align incentives and distribute the risk of integration challenges between both parties. Moreover, by clearly communicating integration cost projections to all stakeholders, including board members and investors, Salesforce set realistic expectations and maintained credibility throughout the integration process. This level of transparency and strategic foresight in deal structuring has become increasingly crucial in the SaaS M&A landscape, where the success of an acquisition often hinges on the smooth integration of complex technologies and diverse corporate cultures.

Mitigate Risks through Strategic Planning

Early identification of potential integration challenges is a critical success factor in SaaS mergers and acquisitions. By conducting comprehensive integration due diligence alongside traditional M&A evaluations, companies can develop proactive mitigation strategies and make more informed strategic decisions. Involving integration specialists who work in tandem with M&A advisors provides a holistic view of the challenges and costs associated with merging two complex SaaS organizations. This enhanced due diligence enables robust scenario planning, where multiple integration pathways are mapped out with associated cost projections. With a clear understanding of potential integration scenarios, companies can allocate resources strategically, establish dedicated integration teams, and assign executive responsibility for managing and monitoring integration costs. Regular cost reviews within this governance structure allow for real-time tracking against projections, enabling quick adjustments to prevent overruns and keep the merger on track financially and operationally.

Risk mitigation in today’s M&A environment requires a sophisticated understanding of integration challenges, especially as private equity involvement and regulatory scrutiny reshape the deal landscape. Beyond standard due diligence, acquirers must engage in advanced scenario planning to model multiple integration pathways and anticipate cost increases from regulatory delays. Recognizing that regulatory reviews may extend a deal’s closure to up to two years necessitates budgeting for additional capital costs and accounting for delayed synergies. Furthermore, private equity players have evolved into strategic operators who significantly boost operational efficiency and margins, making the integration process more multifaceted. These dynamics force strategic buyers to reevaluate their post-merger integration models to account for higher costs and extended timelines, factors that must be integrated into their valuation and decision-making frameworks.

The power of a proactive, structured approach to integration is vividly illustrated by IBM’s acquisition of Red Hat in 2019. Despite the deal’s substantial $34 billion price tag, IBM’s meticulous integration planning and ongoing cost management were widely credited with the acquisition’s success. Central to IBM’s strategy was the creation of a dedicated integration office that developed detailed plans for each phase of the merger process. This careful planning allowed IBM to anticipate and effectively mitigate potential cost overruns, demonstrating the value of a well-structured integration strategy. By prioritizing integration planning and cost management from the earliest stages, IBM navigated the complex merger smoothly, setting a benchmark for successful large-scale integrations in the SaaS industry.

Turning Integration Challenges into Opportunities

As the B2B SaaS industry navigates an increasingly complex M&A landscape, accurately assessing and managing integration costs has become more critical than ever. Heightened regulatory scrutiny and the growing dominance of private equity firms are reshaping deal dynamics, adding layers of complexity to both valuation and integration processes. Regulatory bodies are extending deal timelines — sometimes up to two years — and challenging transactions with greater frequency. Simultaneously, private equity players, armed with a record $2.49 trillion in dry powder, are leading a majority of public-to-private tech deals, introducing new pressures on integration timelines and returns on investment. Companies that excel in integrating these considerations into their strategic planning are better positioned to create substantial value through acquisitions, while those that overlook them risk undermining their competitive advantage and shareholder value.

These evolving dynamics underscore the necessity for senior leaders and executives to adopt a holistic approach that places integration costs at the center of M&A strategy. Advanced scenario planning and proactive risk mitigation are no longer optional but essential practices. By modeling multiple integration pathways and accounting for potential regulatory delays and private equity influences, companies can better safeguard against financial pressures and prolonged timelines. This comprehensive approach enables more accurate valuations, informed negotiations, and strategic decision-making that aligns with both immediate objectives and long-term goals.

Looking ahead, successful acquirers in the B2B SaaS sector will be those who embrace flexibility and adaptability in their integration strategies. The integration process must now account for not just the merging of technologies and cultures but also the external forces of regulatory scrutiny and private equity expectations. By prioritizing integration planning and cost management from the earliest stages of the deal, companies can navigate these complexities more effectively. This proactive stance transforms integration cost management from a potential pitfall into a strategic advantage, turning the challenges of modern M&A into opportunities for transformative growth and sustained value creation.